Standard Bank

Establishing values to the customers

Standard Bank of South Africa, headquartered in Johannesburg, is Africa’s biggest lender by assets. While working for Mobiquity I have helped them reshape and re-invent the bank from the scratch.

MY ROLE & SKILLS

UX Analysis & Research

UX Design

User Interviews

Usability Tests

Persona

User Journey

Value Propositions

Accessbility Design

Ideation & Validation

Prototyping

User Flows / Screen Flows

Wireframes

UI Design

Design System

PLATFORMS

Mobile (iOS & Andriod)

Omni-Channel Experience (Face-to-Face, ATM, Branch Services…)

Web, Mobile App (iOS & Android)

TIME PERIOD

TIME PERIOD

November 2019 - April 2019 at Mobiquity

Challenge

Standard Bank, founded in 1862, already has an established market share. However, with the recent rapid changes to the treands and the market, they have been losing touch in what people really need, hence have been experiencing a low, but steady decline in their user base. In order to prevent a further progression, they consulted with Mobiquity—then together with the team, I was able to help Standard Bank regain the insights to their clientele, understand their customers in what they truly need, so to build a consistent, pleasant experience for the real users.

OUTCOME

We have successfully re-established value propositons of the bank, from which we were able to start applying into specific customer segments.

IMPACT

Standard Bank was not only able to adapt to the newly established value propositions they can anchor around, but they were also able to educate themselves with all the research insights we’ve analyzed and uncovered, helping themselves take a step forward in creating valuable solutions on their feet.

Personally, I not only learned how to uncover the core of the customers’ unhappiness, but I also learned how to shape new values to help them with in the long run. I also was made aware of the tremendous amount of culture difference that could exist, and how to work around it efficiently without impacing my work.

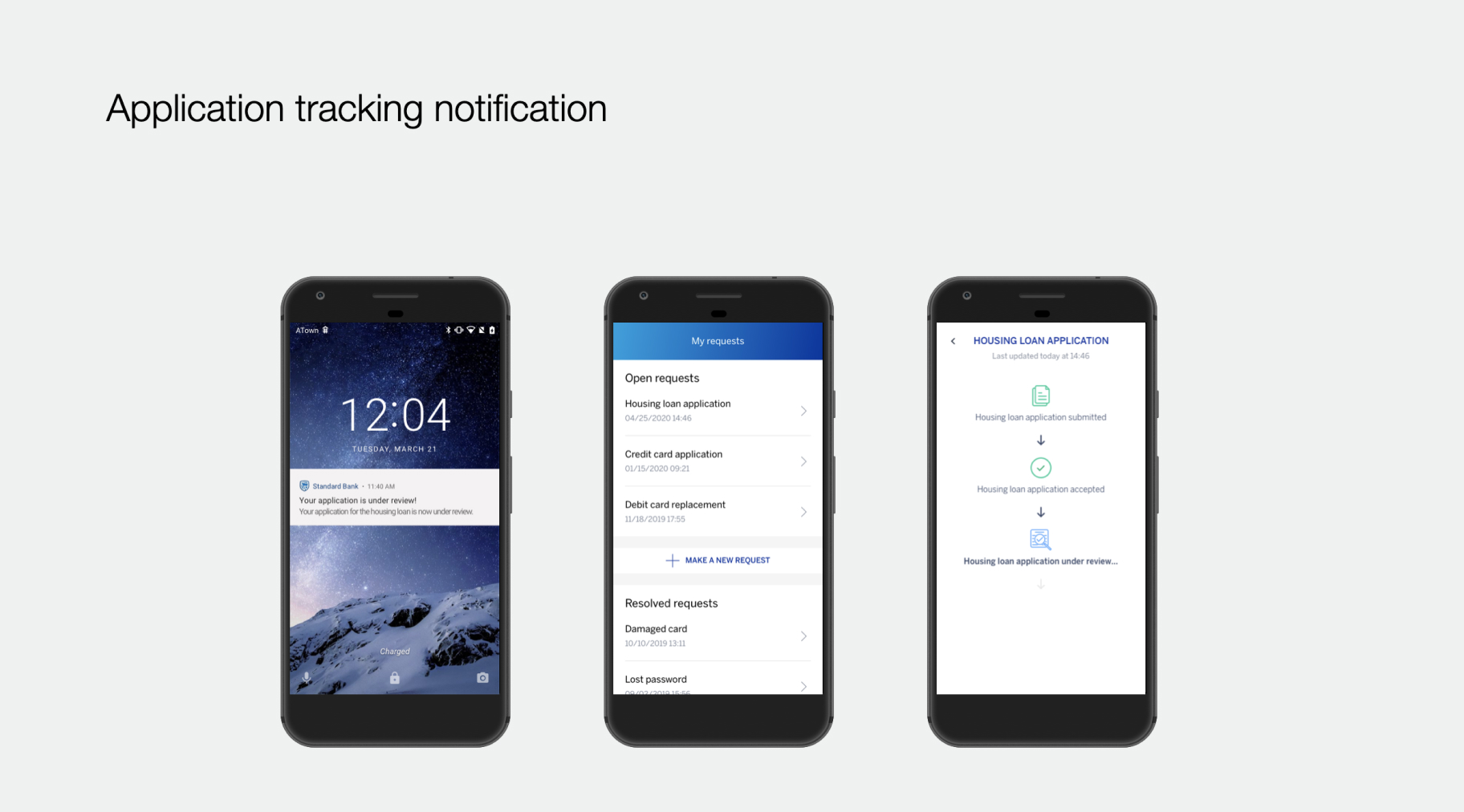

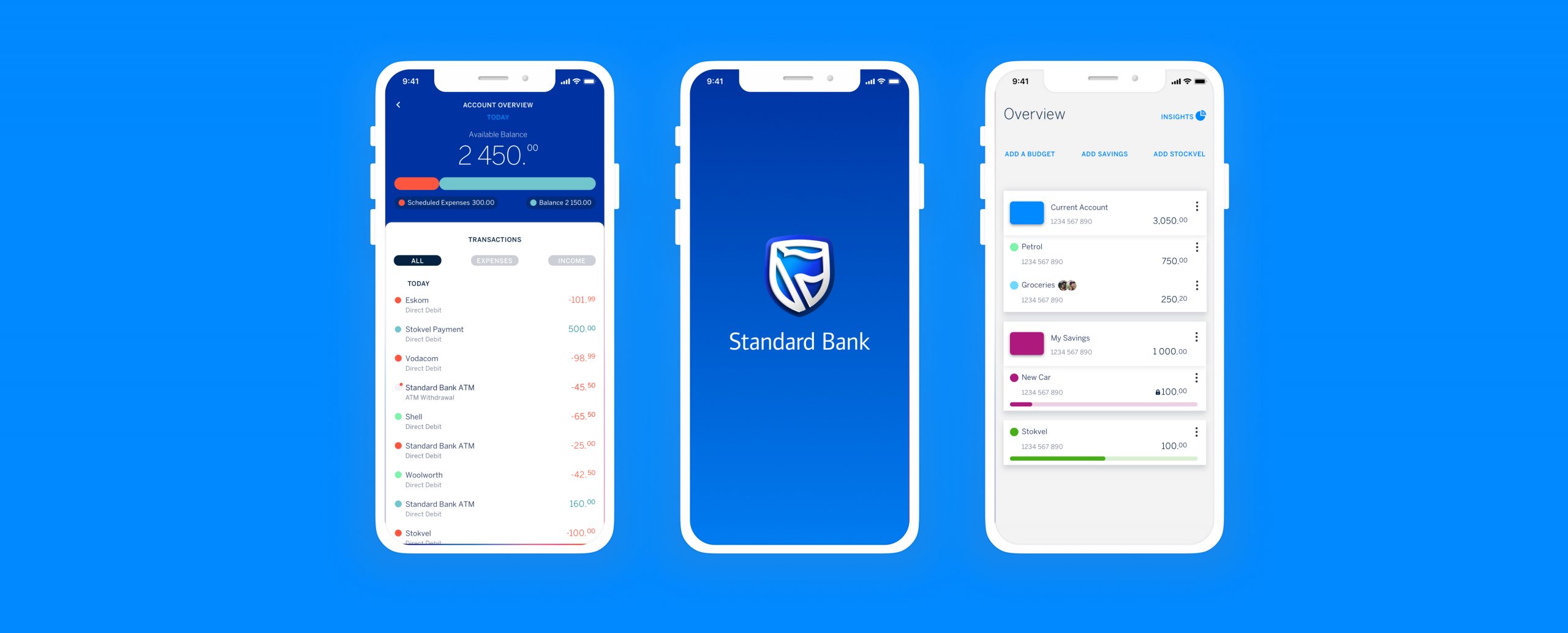

We were tasked with re-designing and re-inventing the online banking platform on both web and mobile. We worked on achieving this goal per feature. After carefully reviewing the requirements, we were able to re-build the entire bank’s online channels from scratch in a way that meets users’ needs. The end product’s goal is to help digitize the every day banking activities in a simplified but secured process.

How we started

Desk research & Data Analysis

To understand the South Africa market and gain the understanding to the customers’ daily circumstances and mindsets, we began researching and analyzing various data the bank possessed from nunber of the customers, complaint logs, as well as conducting independent market data reserach.

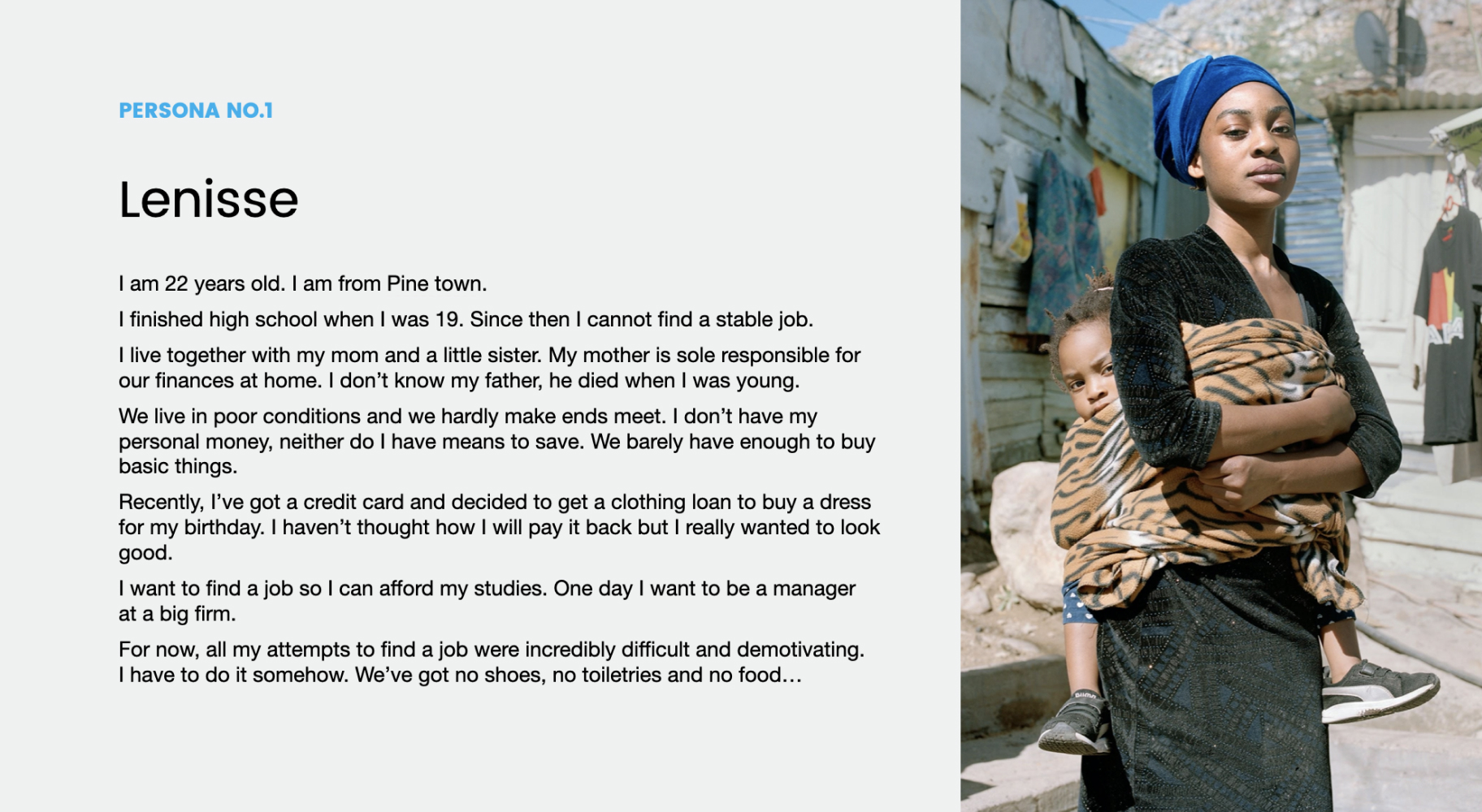

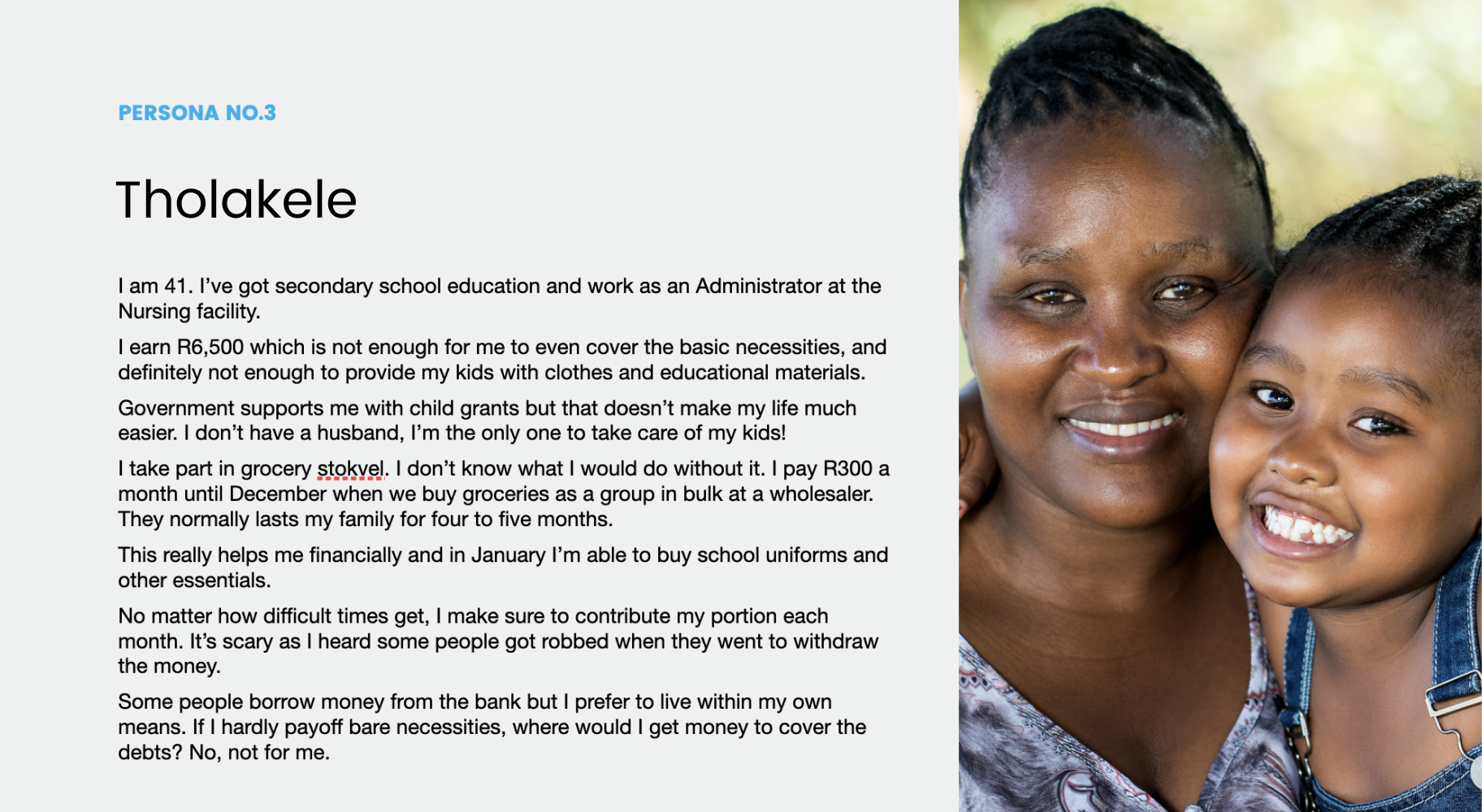

Personas

From the data analysis and the workshop outcomes, we were able to generate a few personas to represent the customers we are most likely dealing with.

The 4 personas to represent the diverse customer bases of Standard Bank

Synthesis

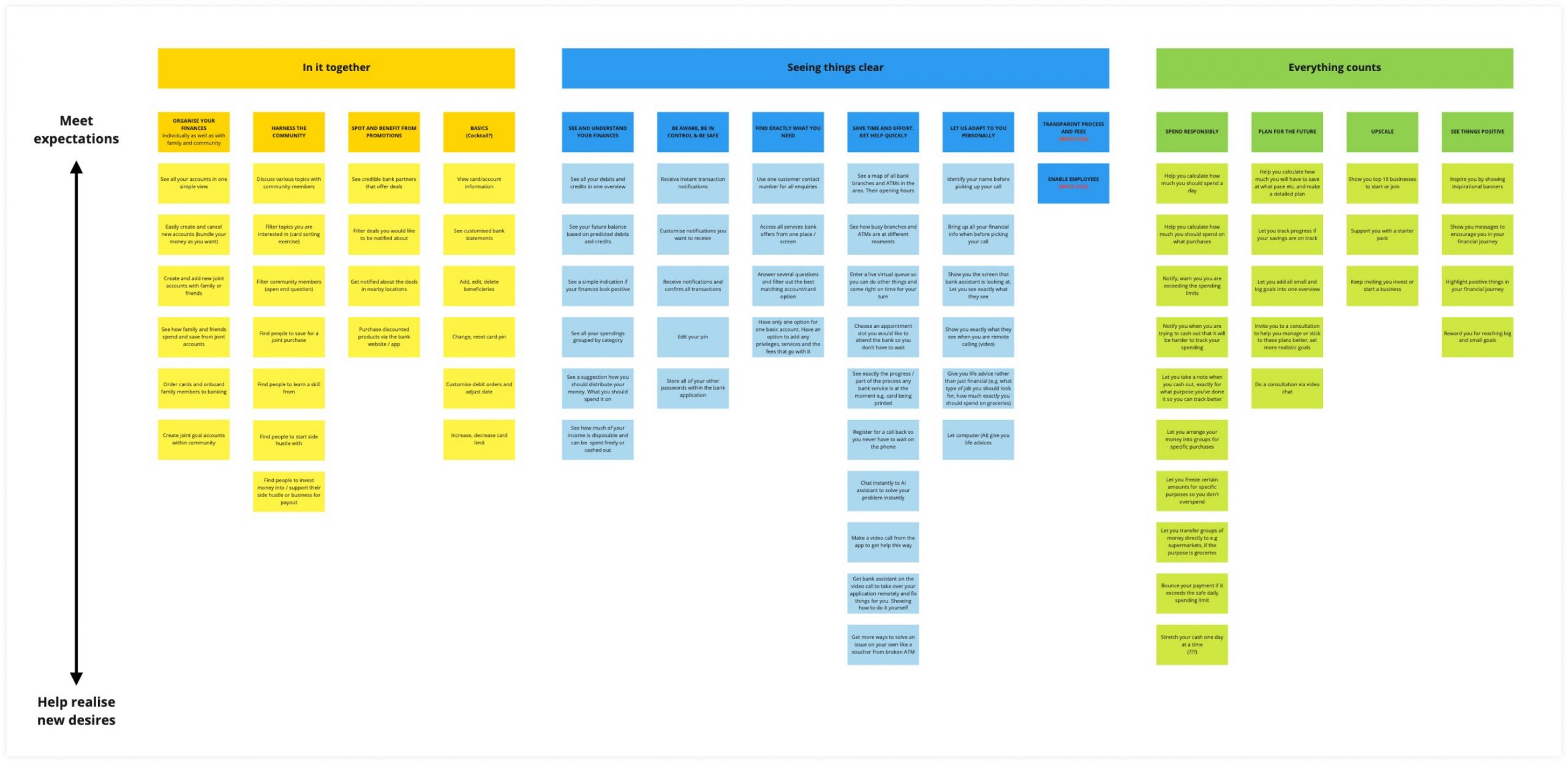

Analysis & Synthesis - Creating value proposition skeletons

After the workshop, we were left to analyze the output. We started gathering the similar ideas together, recognize patterns and combine them into bigger streams of ideas that made sense together. This process eventually generated 3 big ‘buckets’ of possible Value Propositions.

Conceptualization & Validation

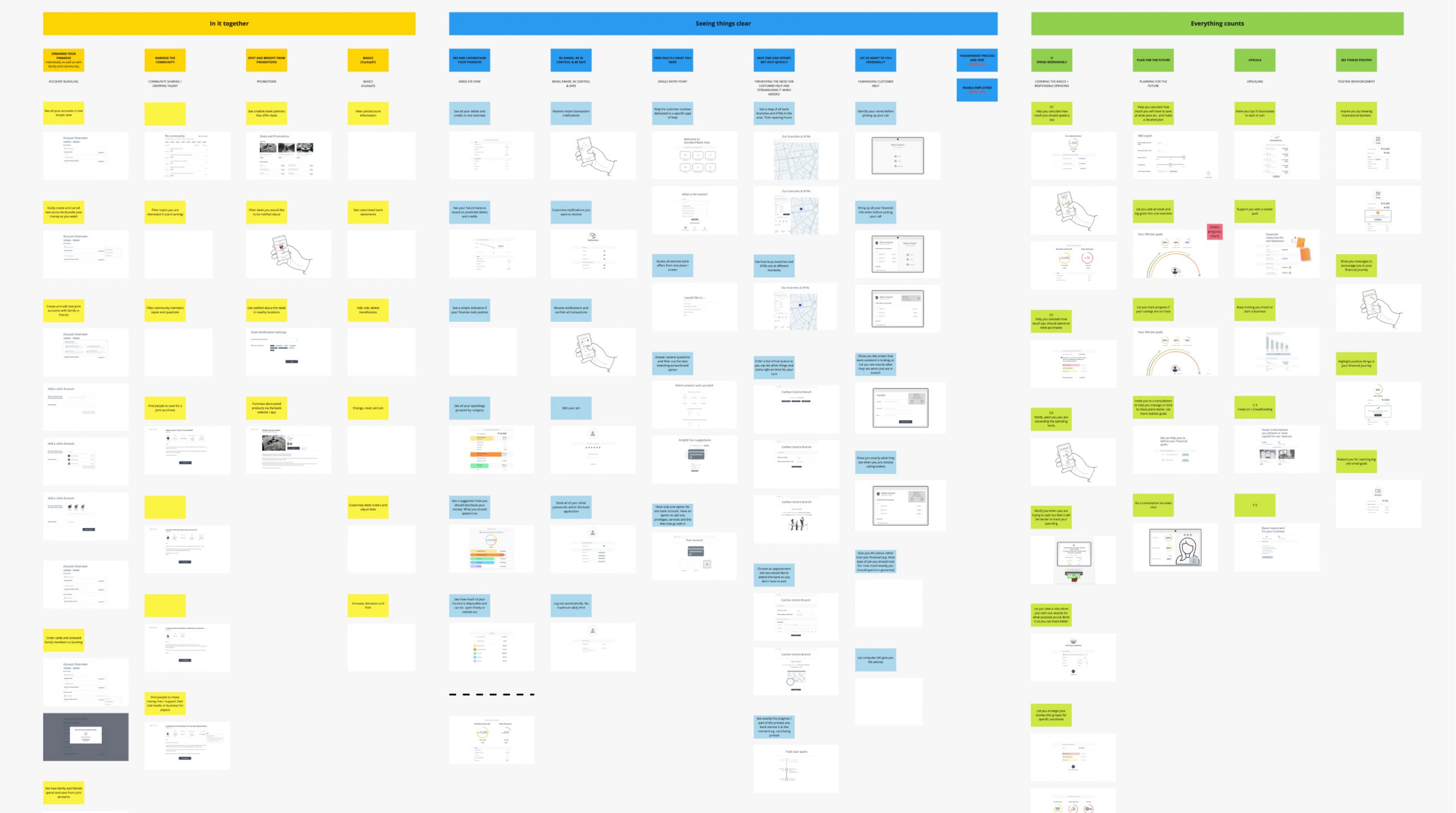

Developing concepts onto screen/paper

When the ideas and the value proposition buckets were set up, we took the individual ideas to sketch out, how it will work and appear like. As our goal wasn’t specific to any digital mediums, some of the ideas were offline or in person, so had to be sketched out carefully to reflect that.

Interviews and outcomes - talking to the end-users

We took the sketched out ideas, printed them out and took with us to South Africa to test out with the recruited end-customers. We had quite a work around as in South Africa sometimes the electricity and the internet wasn’t available--it made for a quite challenging circumstance but also invaluable as we’ve learned tremendously about what works and what doesn’t work with the end-users.

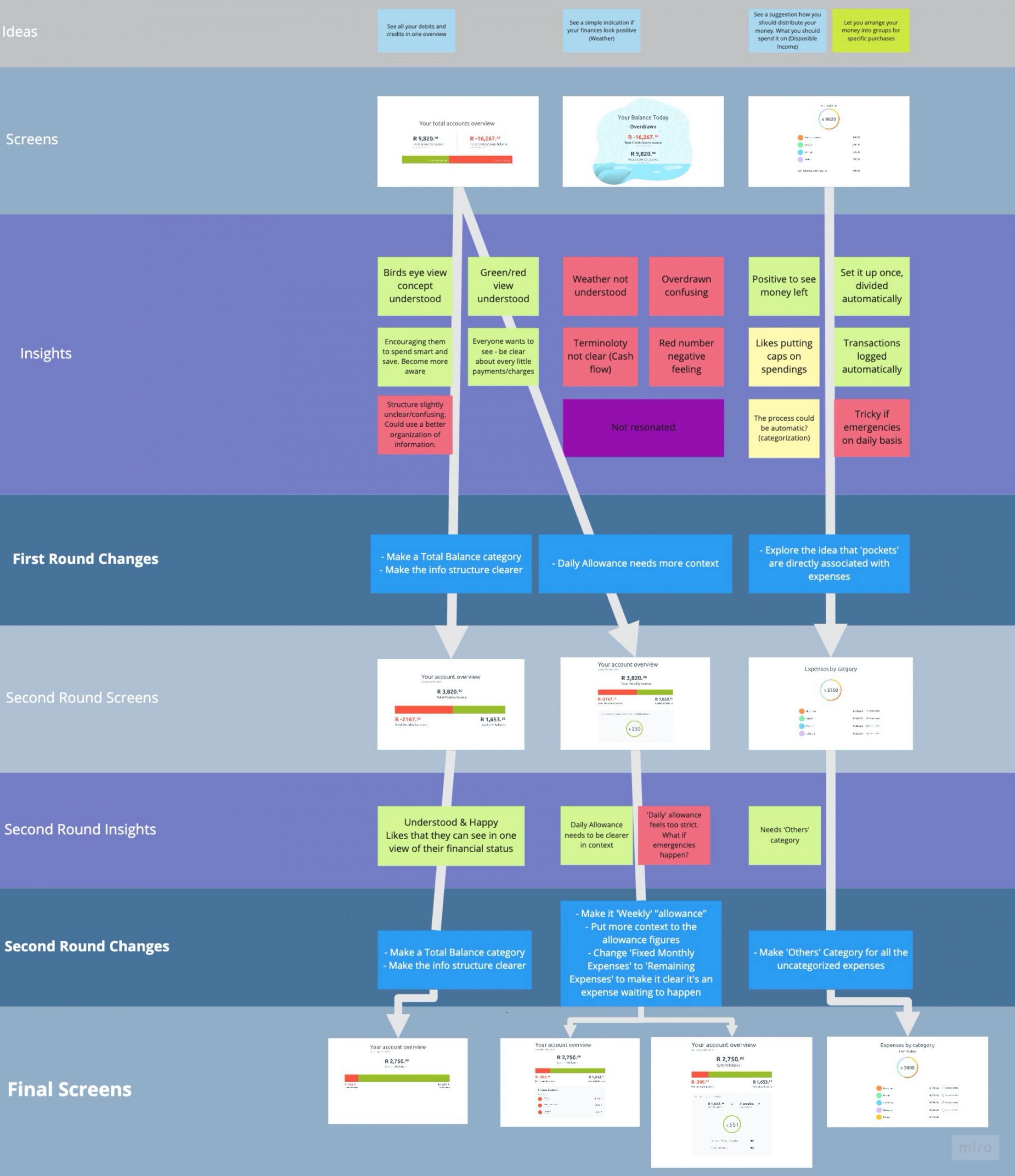

Evolution of the ideas

We have interviewed a total of 24 end customers in intensive two days in South Africa. After each day, we sat down to gather the feedback and the insight, making improvements to existing ideas as needed. In the end, we were left with ideas that resonated with the users with clear insights to indicate why.

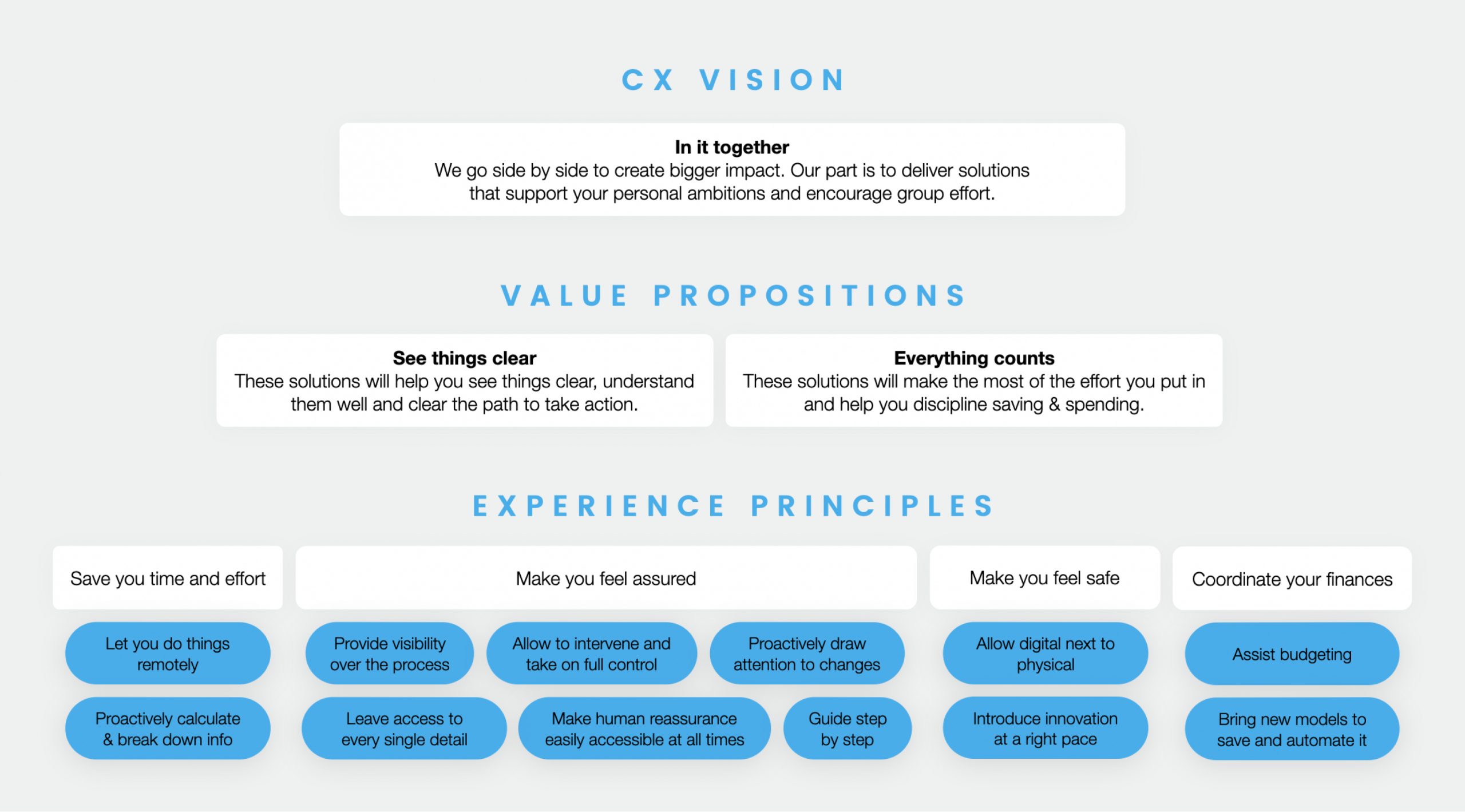

Value propositions

With all the outcome we’ve generated in 2 months time, we were able to establish a clear Customer Experience Vision that overarches newly established Value Propositions, and the Experience Principles to properly execute the values we aim to provide to the customers.

A clear view of the outcome of the Value Propositions.

Refined customer segments: Small Enterprises

Making a proper use of the value proposition we set forward, we were able to dig deeper and apply the knowledge we’ve gathered to more refined, smaller customer segments, enabling Standard Bank to deliver fine-tuned values to each individuals. We’ve assisted them with a refined segment of the Small Enterprises, which include people who own small to mid-sized businesses in South Africa.

Desk research & Data Analysis

To kick off the new customer segment in the right way, we began with conducting the desk research and data analysis into fully absorbing what we know about the Small Enterprises segment currently.

Personas

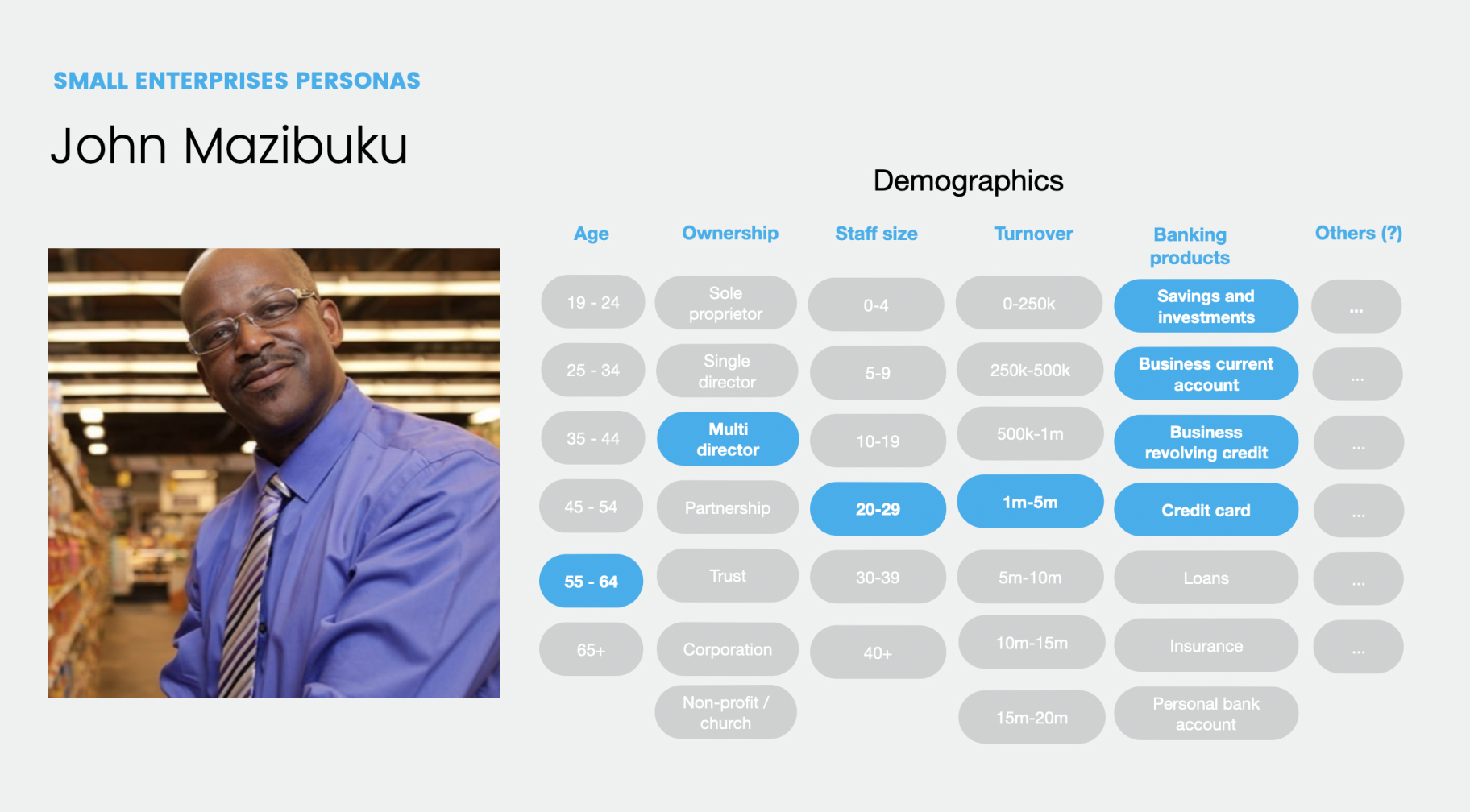

Among the vast knowledge the Standard Bank team already possessed about the customer segment, there were the personas we could utilize. With the 12 given personas, we were able to adapt, tweak and update them with the research and analysis we’ve gathered.

Example of some of the personas we identified during the research phase of the new segment: Small Enterprises

Ideation

Workshop & Ideation session

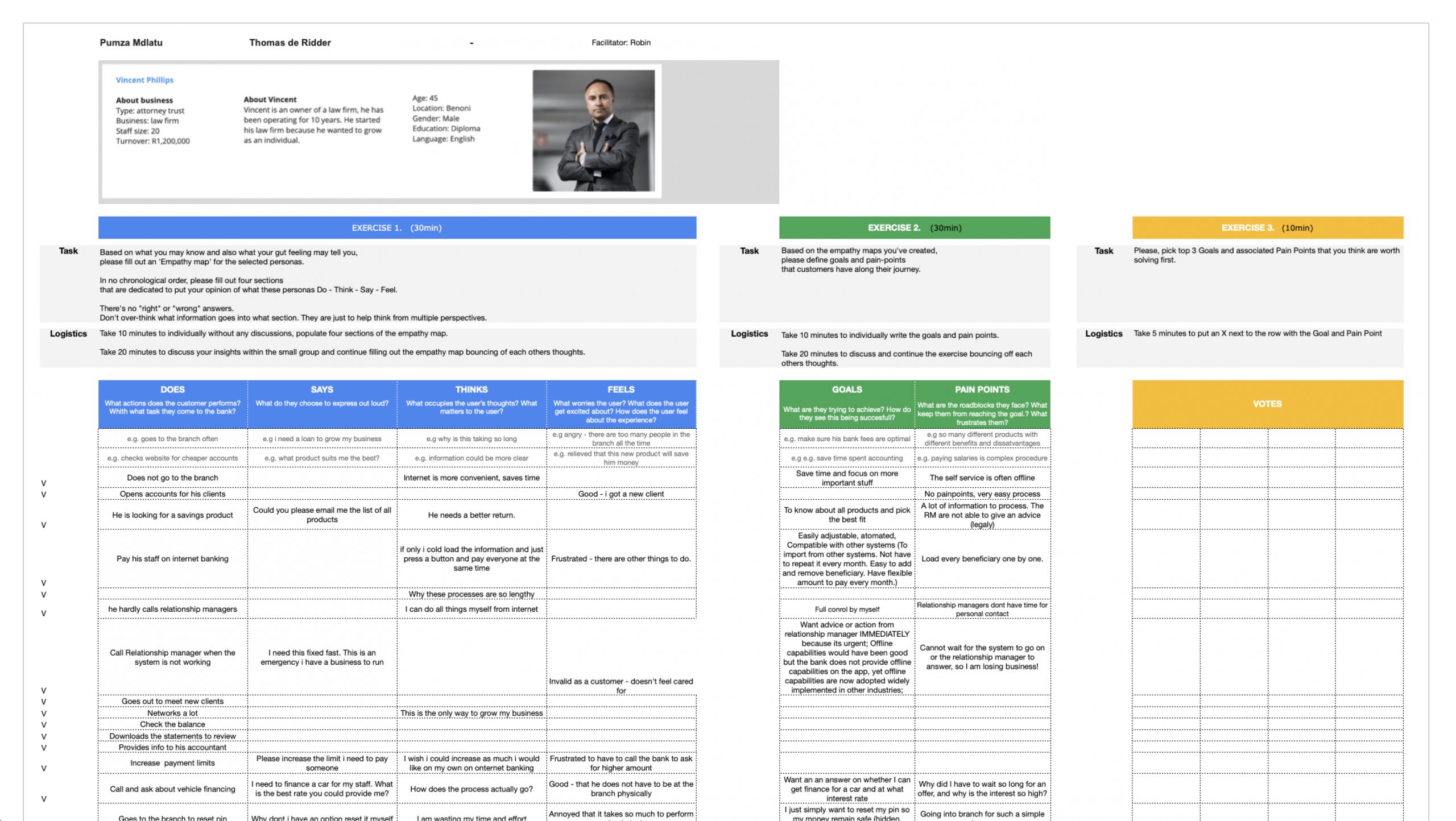

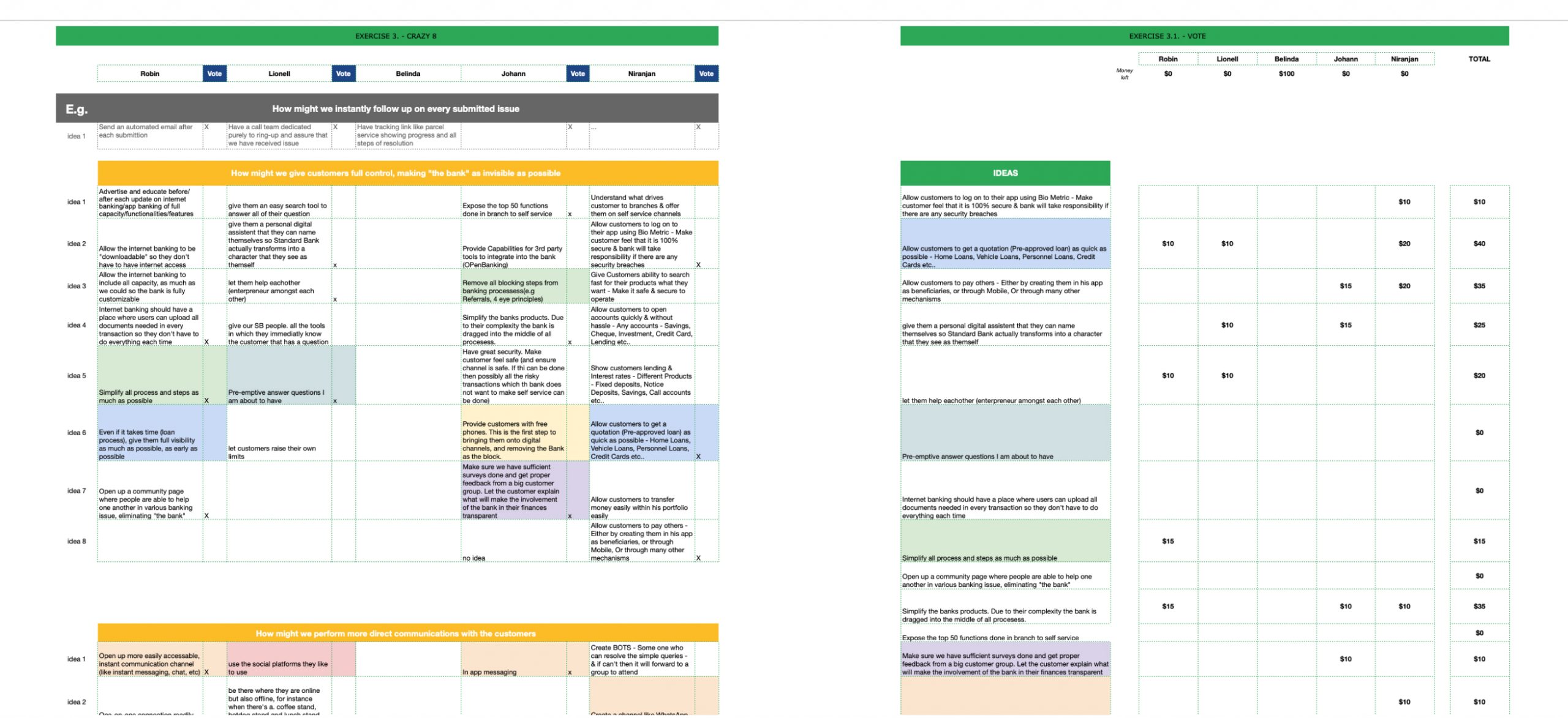

To reach further, our aim was set to not only harness the current knowledge the teams have about the customer segment and the personas, but also to extract new angles to the knowledge, such as the personas’ goals and pain points, so we can ideate how better to help them. We conducted an Empathy workshop for the selected personas, and an ideation workshop to come up with concepts with various people who can help us garner knowledge from the Standard Bank team, including customer success managers, relationship managers, business account consultants and UX researchers. Both the Empathy workshop and the ideation workshop were conducted remotely, using Excel sheet to accommodate the limited resources the South African team was dealing with.

Using the outcome of the Empathy workshop, we’ve conducted an ideation session

Developed ideas and test assets

The ideas that were voted the most during the ideation workshop, we have subsequently developed a series of test assets the Standard Bank team could use to test the ideas to the Small Enterprise customer segment to see if they resonate, so they can move forward with the process on their own even without our consultancy in the future. We have also producted an interview script guidelines to help them with the testings further.

Examples of the ideas we produced for Standard Bank to go ahead and test it out for the market desirability

Examples of the interview script guidelines we prepared for the clients

Conclusion

After about 6 months of extensive research into re-establishing value propositions into two different customer segments, the plan and motion was set into making an MVP. With that, however, Mobiquity’s involvement was to remain a consultant; to guide and educate the Standard Bank teams to be able to design, build and ship their own products autonomously. It was an extensive journey to discover the South Africa market and their pain points and needs, and a pleasure to come up with ideas to be tested with the customers, eventually bringing them help and satisfaction they need.

Robin Sieun Bae © 2024